Lastest News

View MoreAmid loss, Chicago organizations unite to support the family of Dexter Reed after fatal police shooting

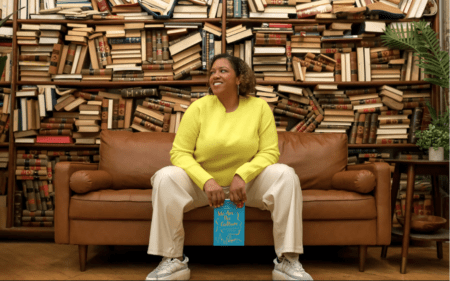

On any given summer day out west in the mid-2000s, Harold Washington College student Tiffany Clark could be found on…

Trending Now

Health

View All In HealthDuring their five-year struggle with infertility, Bre and Chris Yingling went through several rounds of in vitro fertilization, the most recent…

Related Posts

Entertainment

View More EntertainmentThe news about Vocalo Radio being taken off the airways has sent shockwaves throughout Chicago. One former Vocalo host told The…

Sports

View More SportBy Jo Yurcaba The National Association of Intercollegiate Athletics, or NAIA, which oversees more than 83,000 athletes at mostly smaller colleges, has…

Travel & Tourism

More Top Stories

The news about Vocalo Radio being taken off the airways has sent shockwaves throughout Chicago. One former Vocalo host told The TRiiBE…

When The TRiiBE connected with attorney Cierra Norris on April 1, she said she’s no longer the newly minted 27-year-old criminal defense…

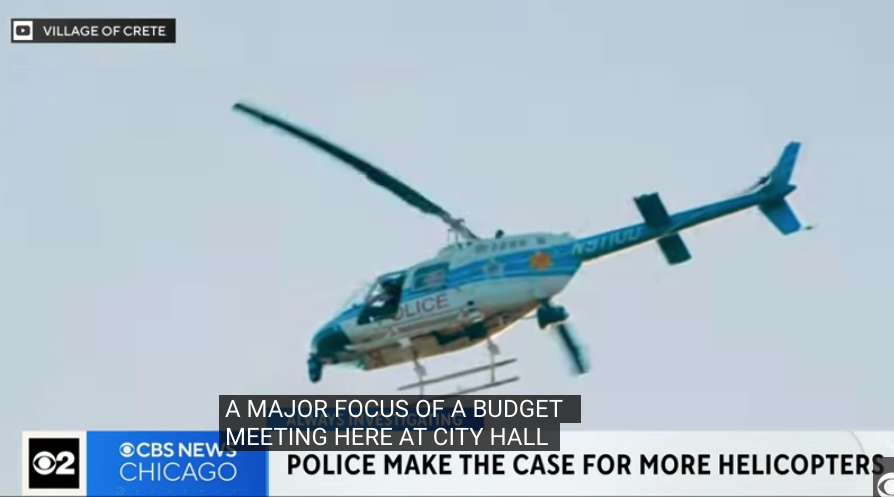

Mayor Brandon Johnson, Civilian Office of Police Accountability Chief (COPA) Andrea Kersten and Cook County State’s Attorney Kim Foxx demonstrated a unified…

By Jo Yurcaba The National Association of Intercollegiate Athletics, or NAIA, which oversees more than 83,000 athletes at mostly smaller colleges, has rolled…