Lastest News

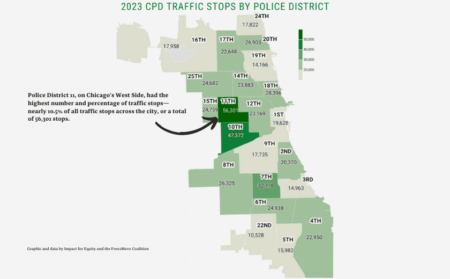

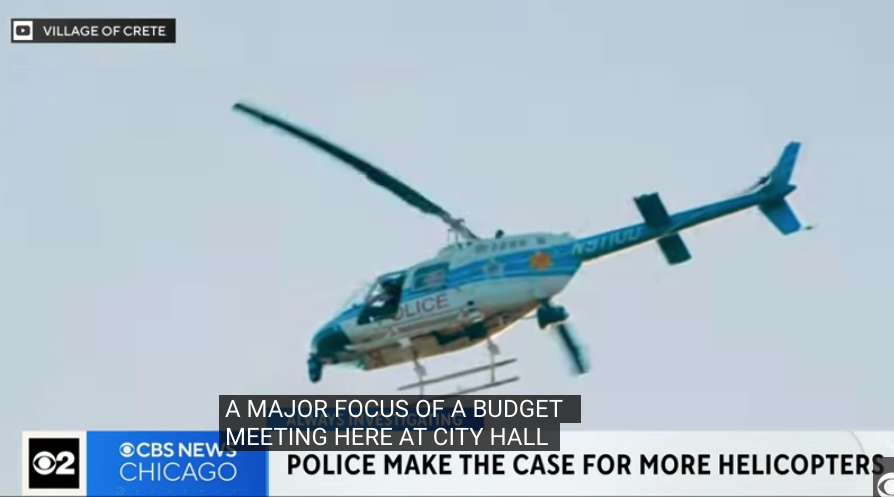

View MoreMayor Brandon Johnson takes steps toward community-centered approach in wake of fatal police shooting of Dexter Reed

Mayor Brandon Johnson, Civilian Office of Police Accountability Chief (COPA) Andrea Kersten and Cook County State’s Attorney Kim Foxx demonstrated…

Trending Now

Health

View All In HealthDuring their five-year struggle with infertility, Bre and Chris Yingling went through several rounds of in vitro fertilization, the most recent…

Related Posts

Entertainment

View More EntertainmentHe moved to Chicago a little more than a year ago, but chef Christian Hunter has taken the city by storm,…

Sports

View More SportBy Jo Yurcaba The National Association of Intercollegiate Athletics, or NAIA, which oversees more than 83,000 athletes at mostly smaller colleges, has…

Travel & Tourism

More Top Stories

He moved to Chicago a little more than a year ago, but chef Christian Hunter has taken the city by storm, earning…

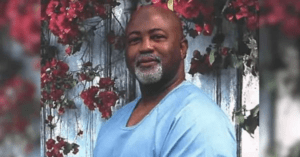

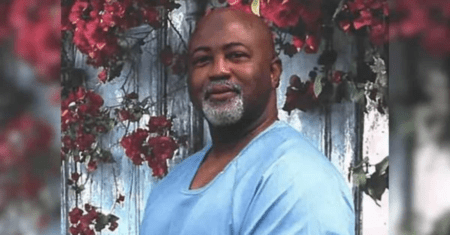

On Wednesday, the family of Dexter Reed and their attorneys filed a federal civil rights lawsuit against the City of Chicago and…

Nearly two years ago, the City of Chicago celebrated a historic moment with the announcement of Bally’s Casino winning the bid to…

For those of you who like to indulge, Chicago’s dispensaries are sure to have a selection of cannabis products worth trying. Here…